While the calendar may still say winter, the North Vancouver real estate market is already showing early signs of spring activity. Each year, momentum tends to build quietly before the traditional March-to-May peak — and that shift is now underway.

For Sellers

Buyers are out there — and they’re prepared.

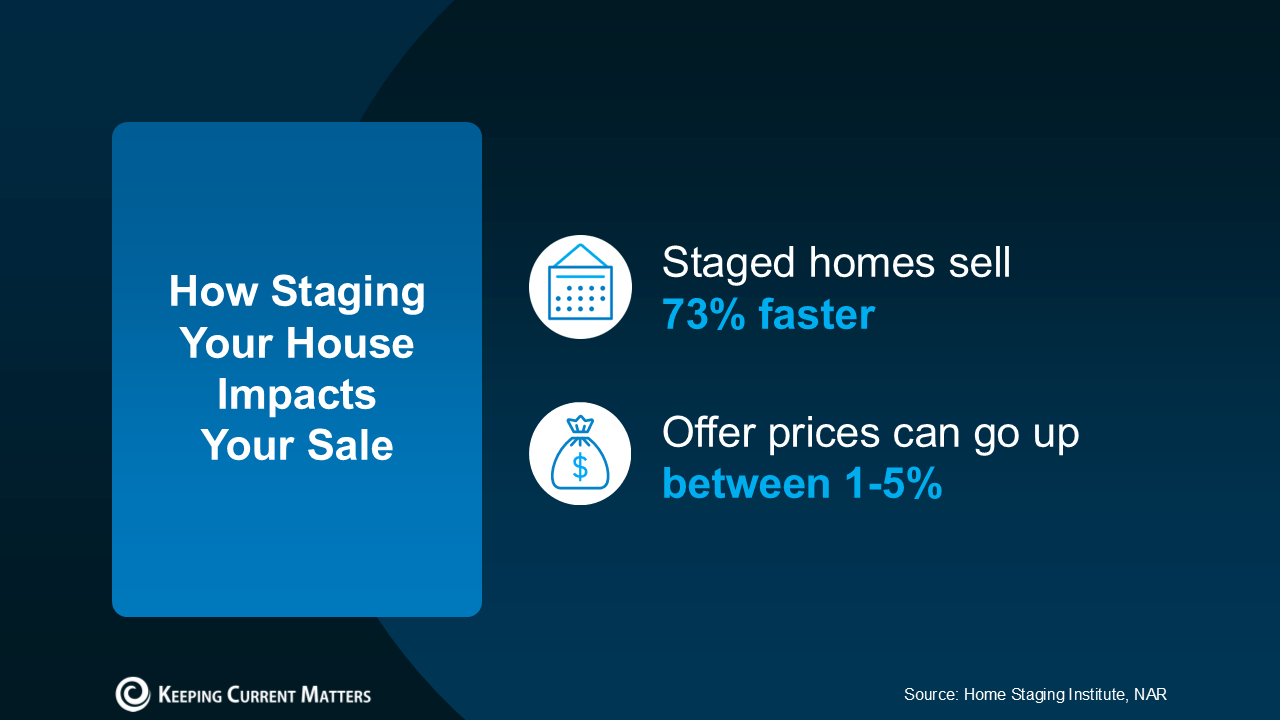

Serious purchasers have started their search earlier this year, watching closely for new listings. Well-prepared homes that come to market now are seeing strong early interest, particularly when priced in line with current conditions.

Competition is growing.

Inventory is beginning to rise, which means sellers entering the market this spring will be competing with more choice than we’ve seen in recent years. Strategic pricing and thoughtful presentation will make all the difference.

Timing can be advantageous.

Listing at the start of the spring cycle can allow your home to stand out before the market becomes more crowded later in the season.

For Buyers

More options are arriving.

As new listings come online, buyers will see greater selection across property types and price ranges. This is often when opportunities appear that weren’t available earlier in the year.

A calmer pace allows for thoughtful decisions.

While desirable homes can still attract strong interest, the overall environment feels more balanced, giving buyers time to evaluate choices carefully.

Preparation remains key.

The most successful buyers are those who are ready to act when the right property appears — particularly for homes that are well-located, well-maintained, and priced appropriately.

OUR PERSPECTIVE

The early spring market often sets the tone for the months ahead. Whether you’re considering selling, buying, or simply staying informed, this is an important moment to understand how the landscape is evolving.

If a move is on your horizon for 2026, even if it’s not immediate, we’re always happy to provide guidance so you can plan with clarity and confidence.