While we expect the Bank of Canada to maintain their commitment and do not expect any rate changes by the end of 2021, some lenders have recently increased their long-term rates. And so, serious buyers are more motivated than ever to find a home before the end of the year.

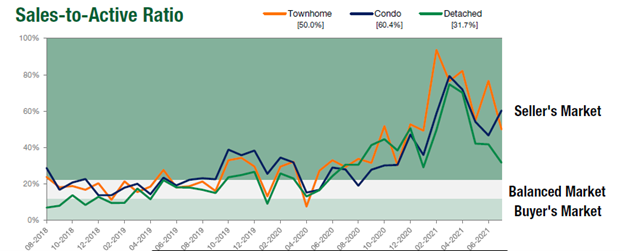

But the sense of urgency they feel is complicated by the lack of homes for sale in today’s market. According to the latest statistics from the Real Estate Board of Greater Vancouver: From one year ago, the inventory of active homes has decreased by 47%.

What Does This Mean for Sellers Today?

With buyers eager to purchase but so few homes available, sellers who list their houses this fall & winter have a tremendous advantage – also known as leverage – when negotiating with buyers. That’s because, in today’s market, buyers want three things:

- To be the winning bid on their dream home.

- To buy before rates rise

- To buy before prices go even higher.

Your Leverage Can Help You Negotiate Your Best Terms

These three buyer needs give homeowners a leg up when selling their house. You might already realize this leverage enables you to sell at a good price, but it also means you can negotiate the best terms to suit your needs.

And since buyer demand is still high, there’s a good chance you’ll get offers from multiple buyers who are willing to compete for your house. When you do, look closely at the terms of each offer to find out which one has the best perks for you.

If you have questions about what’s best for your situation, your trusted real estate advisor can help. They have the expertise and are skilled negotiators in all stages of the sales process.

Bottom Line:

Today’s buyers are motivated to purchase a home this year, and that’s great news if you’re thinking of selling. Connect with your real estate professional today to discuss how much leverage you have as a seller in today’s market.